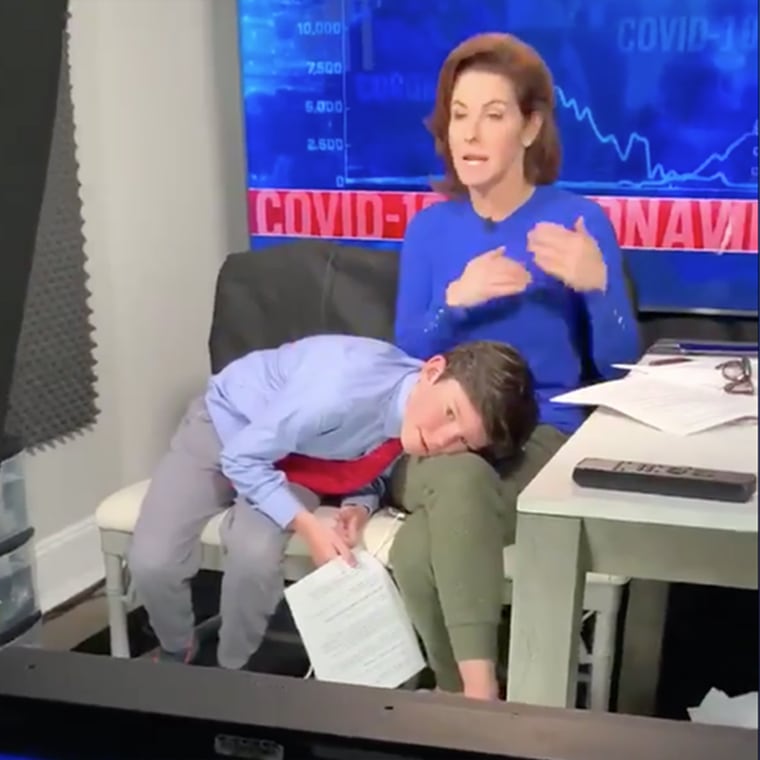

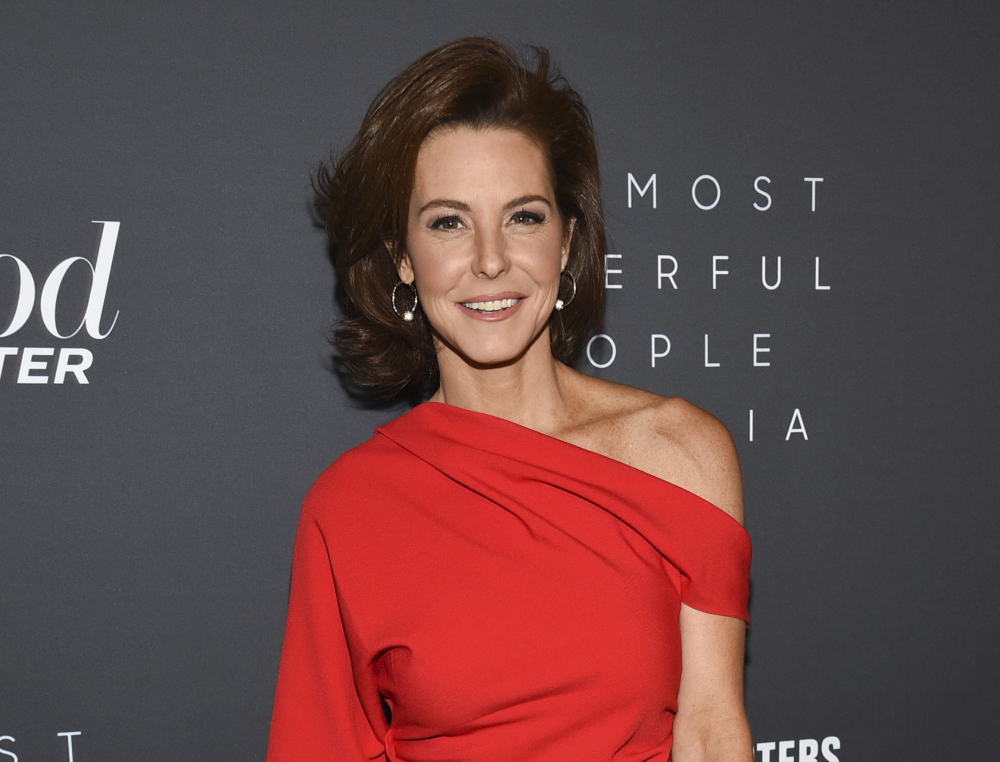

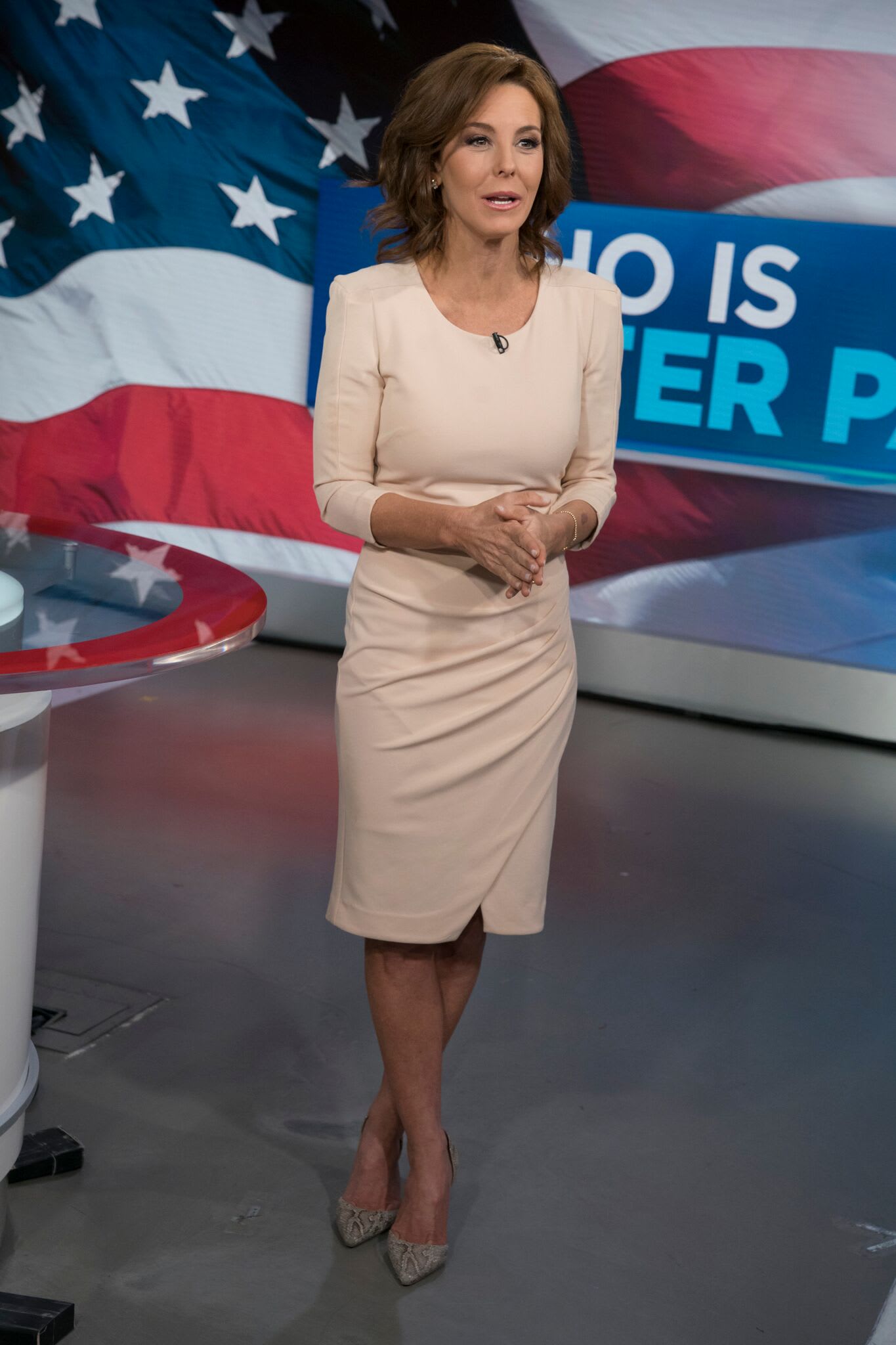

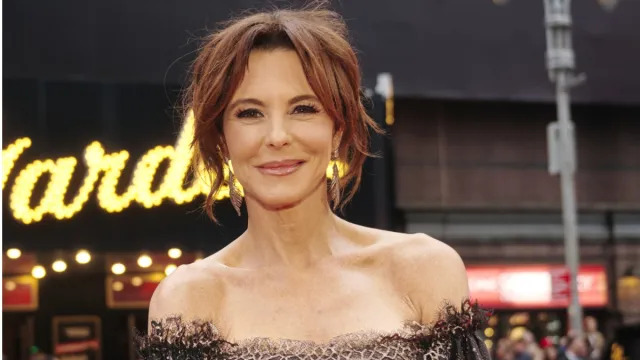

MSNBC’s Stephanie Ruhle Left Fans Stunned as She Revealed How Much Money Her Oldest Son Managed to Save in a Year: “The Kid’s a Savings Genius”

In a surprising revelation that captivated audiences, MSNBC’s own Stephanie Ruhle shared how much her oldest son saved over the past year. The financial journalist, known for her insightful analysis and candidness, expressed amazement at her son’s impressive financial discipline, dubbing him a “savings genius.” This heartwarming moment not only showcased her son’s abilities but also sparked broader conversations about financial literacy and the importance of saving at a young age.

Encouraging Financial Discipline in Children

Stephanie Ruhle’s latest revelation highlights a growing trend among parents: the emphasis on teaching kids about money management early in life. As the world becomes increasingly driven by consumerism, it’s essential for children to understand the value of saving and investing. Ruhle’s son exemplifies how good financial habits can lead to spectacular outcomes. Here’s how parents can help foster a similar mindset in their children:

- Start Early: Introduce basic concepts of money management at an early age. Use simple terms and relatable examples to explain how saving works.

- Set Savings Goals: Help your child establish personal savings goals. Whether it’s saving for a new toy or a larger purchase like a bike, this can instill a sense of purpose in their saving efforts.

- Use Tools: Introduce budgeting tools or apps that make learning about saving fun. Gamifying the process can make it more engaging for kids.

- Lead by Example: Be a role model for your child. Demonstrating your own saving habits can encourage them to imitate those practices.

The Role of Financial Education in Today’s Society

Ruhle’s son achieving significant savings in just one year is not just an individual success story; it reflects a larger societal shift towards valuing financial education. Schools and parents alike are recognizing the importance of preparing children for financial independence.

By providing children with financial literacy tools, they are better equipped to handle future financial challenges, from managing student loans to understanding credit scores. Many parents are now seeking resources and programs that teach their children about budget management, investments, and the importance of saving for the future. As the economy continues to evolve, instilling these skills is vital to help the next generation thrive.

Celebrating Milestones and Building Confidence

When Ruhle shared her son’s savings achievement, it wasn’t just a display of financial success; it also served to celebrate the milestone of accomplishment. Celebrating such achievements encourages kids to continue striving towards their financial goals. Recognizing their efforts reinforces their value and promotes confidence in their financial capabilities.

- Celebrate Savings Milestones: When your child reaches their savings goal, celebrate it! Whether through a small reward or simply acknowledgment, it can motivate them to save even more.

- Discuss Money Management: Have regular family discussions about finances. This can be a safe space for your child to ask questions and share their own experiences.

- Explore Investment Opportunities: As children grow older, involve them in discussions about investing. This can be a vital step in understanding how to grow wealth over time.

The Impact of Social Media on Financial Awareness

Stephanie Ruhle’s announcement resonated with many due to the increasing impact of social media on financial awareness. Influencers and financial experts are utilizing platforms to educate followers about saving and smart financial decisions. As parents share their own stories about teaching children financial literacy, more families are becoming aware of the importance of these discussions.

This growing online discourse is significant because it can lead to greater community support for financial education initiatives within schools and local organizations. With visibility and awareness, a broader movement toward financial literacy is gaining ground, showcasing the importance of teaching children about money management.

Conclusion

In a world where financial education is paramount, Stephanie Ruhle’s revelation about her son’s impressive savings achievement serves as a source of inspiration for both parents and children alike. By fostering good financial habits and encouraging open discussions about money, parents can help their children become financially savvy individuals. If you’re interested in empowering your child with these essential skills, consider taking the steps outlined above. Invest in their financial future today!